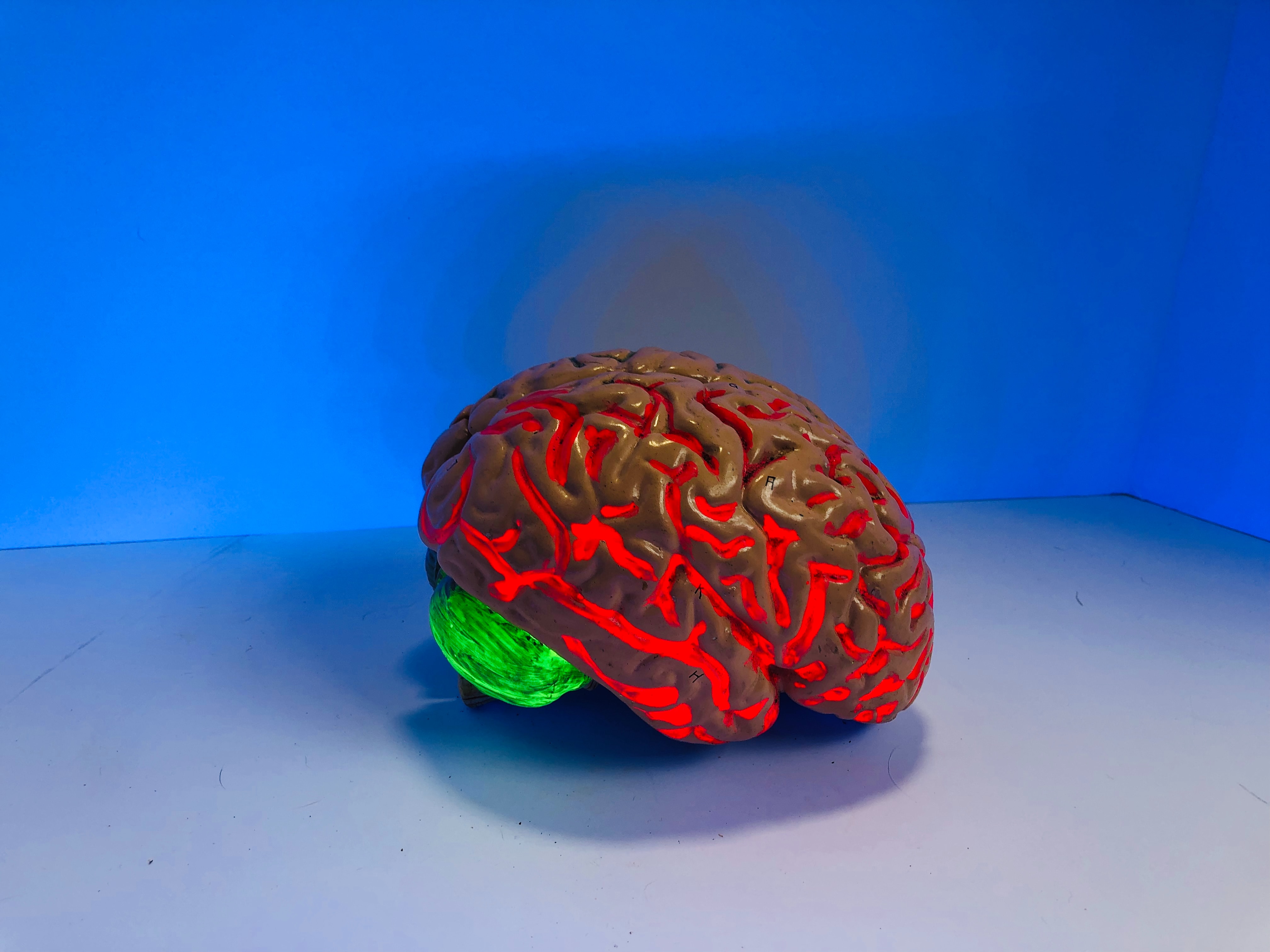

When we think of doing better with managing our personal financial situation, the “better” part typically comes with the picture of more technology, more data or just more external “stuff”. Yet, there is plenty of evidence that hardwired cognitive and behavioral biases are one of the biggest barriers and challenges preventing us from managing money better.