If you had to grade how much better off modern society is with financial products and services today versus what we had twenty or thirty years ago, what grade would you assign? A? A+? Or something even better?

Regardless of what your individual opinion is, it’s an indisputable fact that financial services have become much more democratized and widely available today than they have ever been in the past. Whether you want to invest, save money, track spending, borrow money, whether from an institution or from somebody else just like you, it’s all available right in your palm, with your smartphone.

Yet, I think you’d agree that the feeling of overwhelm has never been worse than it seems to be today. Whether it’s life itself, or the many tasks, chores and even ambitions we feel compelled to take on, there is a sense of helplessness that prevents us from being as happy or fulfilled as we could be, given the shining promise of all these new products.

What gives?

The core problem: a lack of agency

I recently read an insightful and enlightening book by two Boston-based practitioners of psychology. The book, “ The Power of Agency “, makes the claim that the sense of overwhelm that seems to have become the societal norm is preventing us from making decisions and acting on them in ways that will result in fulfilling and meaningful lives.

In other words, overwhelm is causing learned helplessness and a failure to exercise our personal agency.

Where there is a sense of agency, there is also an accompanying hope, optimism and a belief in self that drives us to take actions that we believe will leave us better off. But if we lack this critical sense of drive, of agency, then we tend to languish in circumstances that we know we can make better, yet don’t seem to be able to muster the energy or willingness to get up and actually make those changes.

The causes of this drop in agency are linked with the increased digitization of life, and its consequent impacts on our life. For example, our technology is always on, prompting us to check the latest feeds or news anxiously.

This leads to metric-envy or lifestyle-envy, seeing a peer’s photos garner more attention, or seeing them live an ostensibly “better” life than we think we’re living. Other associated causes like a decrease in physical activity, real life human connections and the always-on work culture only make the problem worse.

The problem of over-stimulation

Photo by Daniele Levis Pelusi

The authors of the book contend that for us to live better lives, we need to implement seven core practices, that have to do with anything from taking care of physical health all the way to using intuition and reflection to enhance agency in all we do.

The first principle to increased agency, though is to ensure that we have a clear head.

The first assault on our sense of agency comes from allowing too much junk into our minds,in essence, an overabundance of external stimuli, that paralyzes our ability to process them, to understand them, and to act on them in ways that make us better off.

What then, are the culprits that cloud our minds and stun our mental faculties?

The core problem is that when the mind is faced with too many stimuli, it does pretty much what your computer does when you see the dreaded “wheel of death” – the spinning that happens when the processor is overloaded.

When your brain is similarly overloaded with stimuli – it stalls and basically comes to a halt. It also produces other unpleasant byproducts like tension headaches, sleeplessness, irritability and anger.

Most importantly, this overload destroys your ability to think, make sound decisions, and act in ways that move you towards your desired destination, whether that be more money in the bank, less spending, or sounder investments.

The link to financial products

Why then, are we talking about all this in connection with financial services? Isn’t this the problem the industry is trying to solve, by increasing the range, power and access to products and services that even kings and queens could only dream of a few centuries before?

There is a link, and it’s a strong one.

There are four sources of stimuli that cause the brain to overload, and one of them has everything to do with financial products.

The first three sources are the usual suspects:

- Baseline stimuli: These come from your tasks of everyday living – dealing with kids, your commute, social interactions, etc.

- Background stimuli: All the ambient sounds, lighting, crowding and other sensory inputs at work or home in your environment

- Digital stimuli: All the stuff pouring into our brains from the ubiquitous screens in our lives – including those that don’t belong to us, such as screens spouting ads in grocery stores , taxis and even in some restrooms.

But the fourth is a big one, and not one you’ll likely think of in this context:

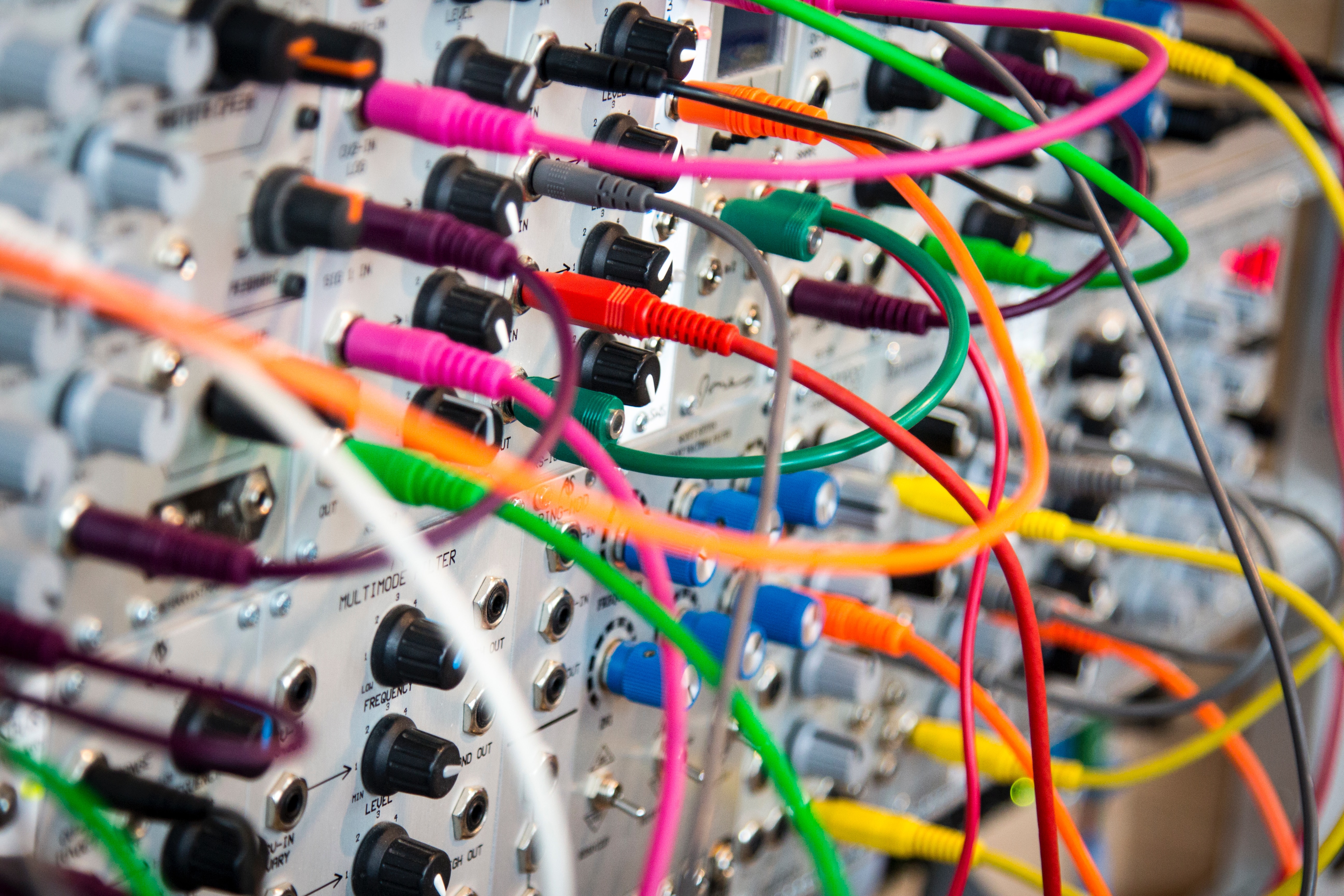

Yes. Technologically-driven systems are becoming increasingly complex in the most critical areas of our lives – and most importantly, these systems have become a key contributor of stimulus overload that directly bombards our limited information-processing capacity and weakens our sense of agency.

Complex systems.

Whether it is making a decision about a financial product, health care, or selecting an insurance option, or even selecting the right number to press when calling your bank to resolve an issue, the level and extent of complex systems we have no choice but to decode has simply exploded exponentially.

Photo by John Barkiple

Each time you have to touch any interface on a financial product – even for something as simple as querying your credit card company about a charge, the cost-minimization and efficiency mandates of most companies extract a toll on your ability to exercise agency. In this way financial services providers have unwittingly become agents of increasing disempowerment in their customers.

The implication for financial services providers:

The implication for financial services providers is simple but far from easy: makes things less burdensome on the human mind. However, doing so will likely involve very significant investments, hard thinking and even a revisit of core aspects of the business and revenue model.

That’s the bad news.

But there’s good news and plenty of it.

The biggest piece of good news is that this insight provides an immense new opportunity for financial service providers to become conscious and significant drivers of empowerment.

If we then also recognize that women in particular may be susceptible to greater overwhelm and a felt-sense of disenfranchisement, then the magnitude of this opportunity becomes immensely greater with a big, well-heeled segment of the market. But regardless of economics, it’s simply the right thing to do.

What this insight also does is that it open ups the playing field enormously for new players. Sharp and nimble entrants can craft a service offering and value proposition completely unburdened by legacy systems and business models – and still be able to leverage the immense power of new technology to make interacting with and buying financial products much simpler and less taxing on the brain. In an increasingly crowded and noisy competitive world, simplicity and parsimony of choice can open up big new vistas.

Imagine a new world in which calling your bank and hearing a friendly (although maybe an AI) voice understand exactly what you’re looking for, and better still, providing it to you with no further hassle is more the norm than the dream. Imagine a world in which you’re provided with small baskets of simple and clearly differentiated offerings, and don’t lose much, if anything, by not accessing the 87 different flavors of investment options or mutual fund flavors.

With a little ingenuity and a lot of focus on who we’re trying to serve in the first place, this scenario is well within reach, and with gains to both sides of the transaction.

From a consumer’s standpoint, the solution is even easier: ruthlessly cut out all complexity from your financial life, with a careful eye to preserving only the absolute essence. Very soon, in conjunction with controlling other sensory stimuli, you should soon start to experience that sense of power and calm that comes from a mind in control and at peace.

Source: The power of agency, Dr. Paul Napper, Psy.D, and Dr. Anthony Rao, Ph.