Nonprofits, or the so-called “third sector” have always been recognized a key contributing segment to the economy and society, and quite rightfully so. As I was trying to build a solid understanding of the nonprofit activity in the women and money space, I came across many laudable groups that were established for and are trying to do amazing things to help women bootstrap themselves to much better financial ground in their lives.

Most of these focus on helping women gain a more solid understanding of the financial landscape, get a grasp on thee key elements of their financial situation, and start to put the foundations of a solid financial footing. One entity however, caught my attention for its completely different vision (for this space), and the professionalism, energy and chutzpah with which it is going about its business.

First, some background:

It would make sense to expect that a business or industry that serves a particular segment would strive to include members of that segment in its ranks: after all, who better to understand your customers than other customers themselves?

Yet, the investment industry, which, as we’ve seen before, touches the lives of millions of women, has a severe representation problem. This problem isn’t unique to this business of course, and the typical responses seem to center around more advocacy, employee interest groups and internal initiatives to include or promote women from within the ranks.

Girls Who Invest: a different vision for women and money

Here’s where Girls Who Invest (GWI) boldly strikes a different path: The organization was founded just three years ago, in 2015, by Seema Hingorani, a Wall Street professional herself who got tired of the low representation of women in the investment industry.

Ms. Hingorani’s investment credentials are enviable, with stints managing large portfolios including that of the $160 billion New York City Retirement System.

GWI’s mission is clear and concise : to increase the share of global investable assets managed by women to 30% by 2030. They seem to have their work cut out for them:

- In North America, less than 10% of portfolio managers are women

- Only 6% of the chief investment officers of the largest institutional U.S. money managers are women.

- Only 6% of senior leaders in private equity are women, 4% in real estate and 3% in hedge funds

- In contrast, women make up 33% of doctors and 35% of lawyers in the U.S

Their strategy is also simple: because investment firms say they do not see enough resumes from women, the organization aims to create a pipeline of motivated and talented young women who are well-equipped and ready to succeed in the industry

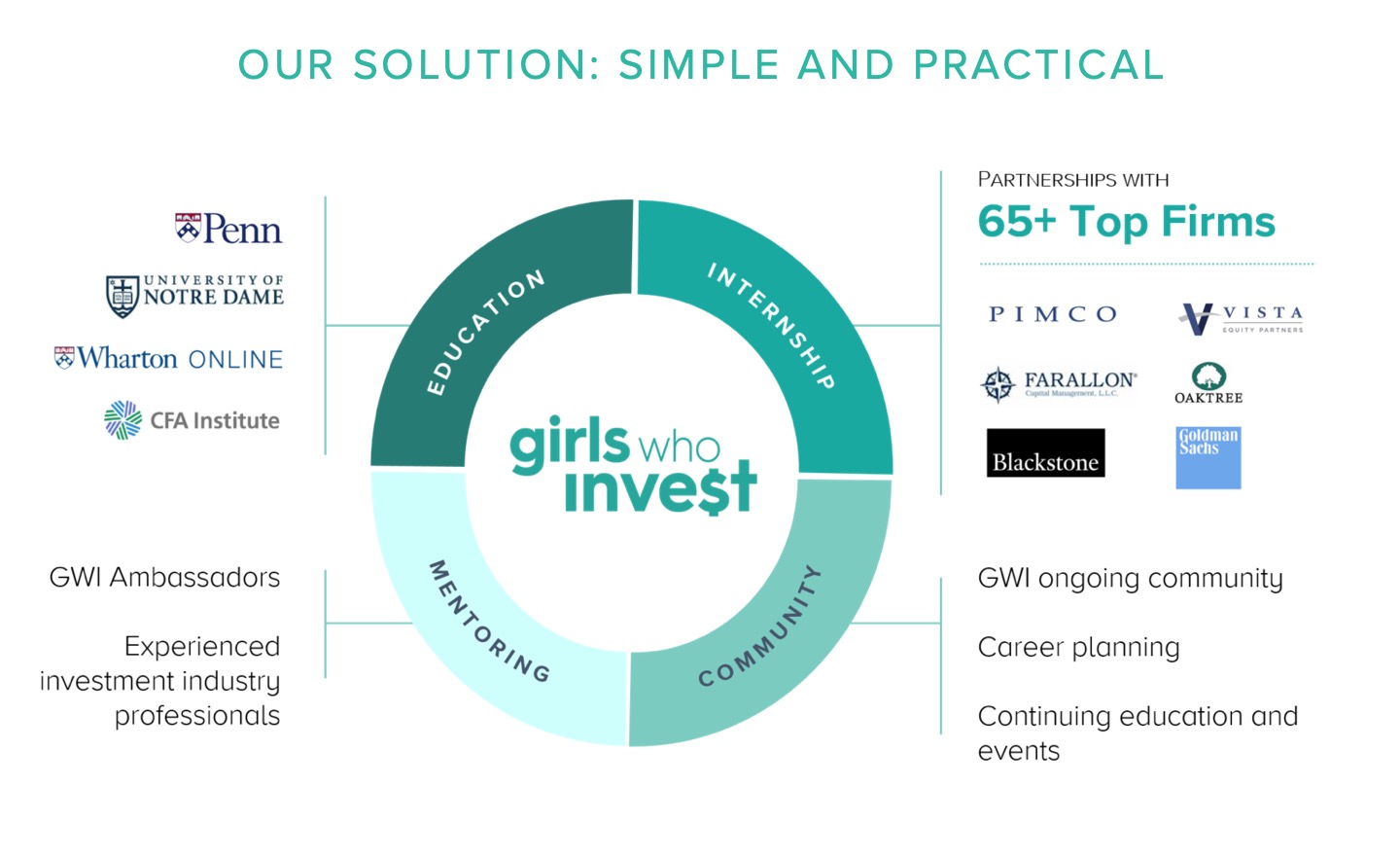

The model: thoughtful mix of education, opportunity and support

GWI’s model is simple and thoughtful, with four components:

Education:

GWI partners with multiple leading educational institutions including the University of Pennsylvania, Wharton Online, the University of Notre Dame as well as the CFA Institute to provide targeted education to a select group of young women who are accepted into the program each year.

Paid internships:

The program also provides meaningful paid internships with companies including Goldman Sachs, PIMCO, Oak Tree and Blackstone, all blue-chip names in their respective businesses. This opportunity and access is absolutely critical to helping these aspirants land on a firm footing at the start of their careers.

Mentoring:

GWI doesn’t stop there: one of their ongoing outreach efforts is to recruit industry professionals as well as professors to provide mentorship to graduates and students of the program, ensuring that there is continuity and support as these women grow in their careers and one hopes, assume positions of increasing influence and responsibility.

Community

Lastly, GWI seeks to build a community not only of current and past participants and other supporters, but also provide career planning and continuing education and event

The results are impressive

In just three years, GWI has impacted 500 women, and not just a homogeneous group either. According to the organization’s website:

- Over a quarter, or 26% of its scholars come from socioeconomically challenged backgrounds

- 20% are historically underrepresented minorities

- Scholars collectively represent 40 different undergraduate groups.

The program seems sticky too: over 80% of scholars stay in the investment business, building a solid base for fulfilling the organization’s mission.

To ensure the ongoing integrity and strength of its vision and execution, GWI has put together an impressive board of directors, supported by governance processes that effectively build on its roots in the investment business.

Concluding thoughts:

In looking at this organization and the overall picture, I found it very hard not to be impressed with both the vision, as well as the energy and chutzpah with which it is being implemented.

The combination of the bold vision, the solid design of the program and its supporting components , and the caliber of the people who are responsible for its success both on the inside and in academia are hard to beat.

But what I love most about Girls Who Invest is that it aims for leverage: seeking to make change far upstream of where other nonprofits seek to play – right at the source.

My plug for this organization: if you are an investment professional or academic, there are great opportunities to support the community as mentors.

I find myself rooting for such a great vision, its team, and most of all, for the ambitious young women who want to make an impact by playing the industry’s game on its own terms!

Source: Girls Who Invest